Adressing the European Parliament last November, Pope Francis issued a dire warning based on a fresco by Raphael in the Vatican. Depicting the “School of Athens”, it shows the two ancient Greek sages, Plato and Aristotle, with the former pointing upwards, and the latter, outwards. This, the Pope said, represented the constant and necessary interplay, crucial to European history ever since, between the transcendent – the heavenly – and concrete reality: the earthly. “The future of Europe depends on the recovery of the vital connection between these two elements,” he told Europe’s leaders.

As an analysis of the crisis that has overtaken modern-day Athens, his speech could hardly be bettered. The transcendental vision of peace and harmony that launched the movement towards European unity had been replaced “by the bureaucratic technicalities of its institutions” which were engaged in “laying down rules perceived as insensitive to individual peoples, if not downright harmful”. If anything, that description understates the likely effects of the harsh terms that Greece’s creditors have tried to impose on it, in return for keeping the Greek economy afloat a little longer.

They could even be grudgingly justified if there was light at the end of the tunnel. The sense of a necessary sacrifice in the hope of better things to come is what is enabling other eurozone countries like Italy, Portugal, Spain and Ireland to endure their own dose of austerity. The transcendent beckons, enabling the concrete reality to be faced. But Greece is different. The end of the tunnel is still dark. The International Monetary Fund, echoing the views of economists left, right and centre, sees Greece as condemned to ever-increasing penury. The expert consensus is that the proposed new bailout of the Greek economy is even less likely to work than the last one – unless there is a massive write-off of Greek debt. But that is forbidden by the “bureaucratic technicalities of its institutions” and the rules they follow. Bizarrely, Greece is being told to borrow from its creditors – new debt – in order to pay back its creditors – old debt. The money to be borrowed would not assist the Greek people, except to the extent that it would allow their cash machines to work once more; it would simply help German and other northern European banks to show a profit.

It does not take an Aristotle to see that the euro is a currency system with a flawed design. The German trade surplus is of the order of €200 billion (£140bn) a year. This comes at a cost to the remainder of the eurozone, whose trade deficit matches Germany’s surplus. In brief, German banks have been lending foreigners money to buy German goods. But the logic behind German policy, that other countries should become more like Germany, is self-defeating. Even disregarding basic historical and cultural differences, they cannot all run a surplus at once. There has to be a proper circulation of wealth, returning it from the richer north to the poorer south. The writing off of debt – anathema in Berlin and Frankfurt – is one of the ways that could happen. Unless these economic and moral flaws are addressed, however, the eurozone will become increasingly unstable. And where Greece goes today, others will go tomorrow. But that is hardly what the Pope had in mind.

16 July 2015, The Tablet

No light at the end of the tunnel

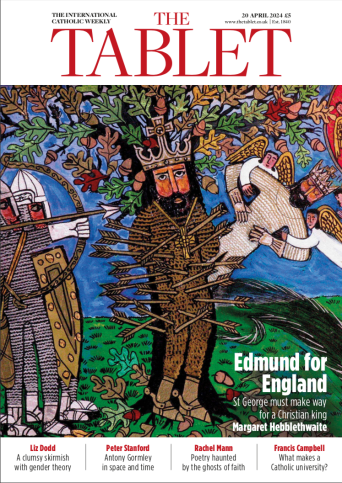

Edmund for England

Loading ...

Loading ...

Get Instant Access

Subscribe to The Tablet for just £7.99

Subscribe today to take advantage of our introductory offers and enjoy 30 days' access for just £7.99

What do you think?

You can post as a subscriber user...

User Comments (0)