Economies expand when consumers have money to spend; when they do not, economies shrink. That is an economic truth clearly grasped by the Chancellor of the Exchequer, but appears to be missing from the mental toolkit of those negotiating with the Greek Government. This contrast may even explain why George Osborne’s recent comments on the Greek crisis seemed unexpectedly sympathetic to the case put by the Greek Prime Minister, Alexis Tsipras – that after five years of forced austerity and a 25 per cent drop in GDP, his country’s economy has taken more punishment than it could bear. It needs a blood transfusion, not a further application of leeches.

Before Mr Osborne’s budget on Wednesday, the idea had taken hold that he thought the British economy needed another heavy dose of austerity, and that he intended to do that by cutting welfare payments by £12 billion, thereby taking money from the poor. Indeed he did take that, but found a way of giving it back to them – in many cases, more than he took. His prime target was the system of working tax credits, which allows low-paid people to bolster their income to a sustainable level at the taxpayers’ expense. Not only did this create benefit dependency among those in jobs; it amounted to a state subsidy to employers who paid their employees badly. Mr Osborne conceded that very point, and then announced a so-called National Living Wage, which would force employers to pay better wages. To help them bear the cost he reduced corporation tax and the employers’ National Insurance contribution. And how would all that be paid for? By savings in the benefits budget.

That is another financial merry-go-round of the sort the Prime Minister had criticised a few weeks earlier, but this time benign in intention and effect. It is also similar to Labour policy, though by 2020 the new minimum wage, at £9 an hour, will be even more generous than the £8 an hour that Labour promised. Above all, it puts spending power in people’s pockets, so the national economy is further boosted. As it also should be by the Chancellor’s raft of measures to lift regional economies.

Greece, meanwhile, is seeking relief from a burden of debt that has become unrepayable. But the IMF and other creditors, principally Germany, are obsessed with their perceived moral duty to extract every last pound of flesh from the Greeks. Greek voters turned down further austerity in a general election in January, and again in their referendum last weekend. So Mr Tsipras’s hands are bound. When he calls for “an agenda for economic growth” that must be the right way forward. It means Greek consumers having money to spend, not taking more of it away. As in The Merchant of Venice, taking the full pound of flesh would assuredly kill the debtor. And as a consequence the Germans would receive nothing in return but a feeling of righteousness.

09 July 2015, The Tablet

Power in people’s pockets

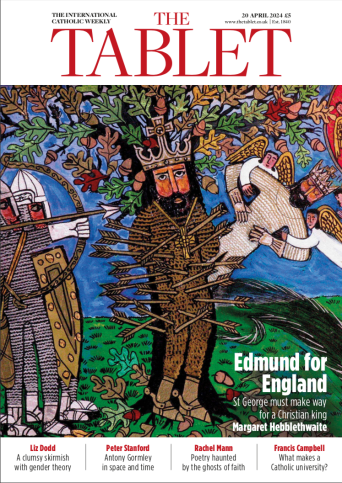

Edmund for England

Loading ...

Loading ...

Get Instant Access

Subscribe to The Tablet for just £7.99

Subscribe today to take advantage of our introductory offers and enjoy 30 days' access for just £7.99

What do you think?

You can post as a subscriber user...

User Comments (0)